In the ever-evolving landscape of banking and finance, one innovation stands out as a symbol of convenience and accessibility—the Automated Teller Machine (ATM). Let’s take a journey through the history, impact, and evolution of the ATM, a technological marvel that has reshaped the way we interact with our finances.

The Genesis of Automated Banking

The Invention of the ATM

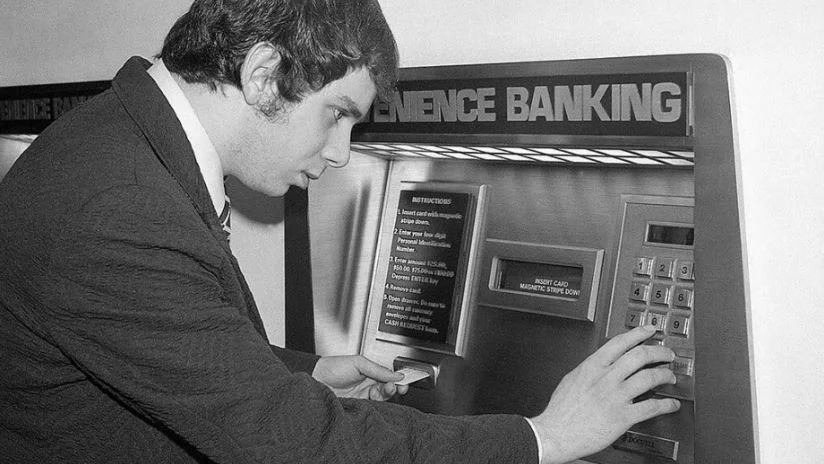

Unveil the origins of the ATM and its revolutionary impact on traditional banking. Discover the inventor behind this financial game-changer and the initial vision that sparked its creation.

A Revolution in Banking Accessibility

Explore how the ATM transformed banking into a 24/7 service, liberating customers from the constraints of traditional banking hours. Understand the early challenges and successes that marked the adoption of ATMs.

Understanding the Mechanics

How ATMs Work: Behind the Scenes

Demystify the inner workings of ATMs, from card authentication to cash dispensing mechanisms. Delve into the technology that ensures a secure and seamless user experience.

Evolution of Features: Beyond Cash Withdrawals

Trace the evolution of ATM features beyond cash withdrawals. Examine the introduction of functionalities such as check deposits, bill payments, and fund transfers.

Impact on Banking and Society

Financial Inclusion: Bridging Gaps

Examine how ATMs have played a pivotal role in promoting financial inclusion and bringing banking services to remote and underserved areas. Explore case studies illustrating the transformative impact on communities.

ATMs in a Digital Age: Challenges and Adaptations

Discuss how the rise of digital banking and online transactions has influenced the role of ATMs. Analyze the challenges faced by ATMs in a digital era and the strategies adopted for relevance.

FAQs about ATMs

Q: Who is credited as the inventor of the ATM?

A: The ATM is attributed to John Shepherd-Barron, a Scottish inventor who conceptualized the idea of a self-service cash machine.

Q: When was the first ATM installed for public use?

A: The first public ATM was installed in Enfield, London, in June 1967, at a branch of Barclays Bank.

The Future of ATMs: Innovations and Trends

Biometric Security: A New Era of Authentication

Explore the integration of biometric technology in ATMs, such as fingerprint and iris recognition, enhancing security measures.

Contactless and Cardless Transactions

Discuss the emerging trend of contactless and cardless transactions at ATMs, providing a glimpse into the future of frictionless banking.

Conclusion: The ATM Chronicles Continue

As we reflect on the journey of the ATM, from its humble beginnings to its multifaceted role in the digital age, one thing becomes clear—it’s far more than just a cash dispenser. The ATM has woven itself into the fabric of our financial routines, embodying the essence of accessibility and convenience.

In the grand narrative of financial evolution, the history of the ATM unfolds as a tale of innovation and accessibility, with each transaction echoing the footsteps of progress.